For the taxpayer, this means that if a company sells an item oncredit in October 2018 and determines that it’s uncollectible inJune 2019, it should present the results of the bad debt when it filesits 2019 tax return. This application most likely violates thematching principle, but if the IRS did not have this policy, therewould sometimes be a significant amount of manipulation on companytax returns. For instance, if the company needed the deduction forthe write-off in 2018, it might claim that it was actuallyuncollectible in 2018, as a substitute of in 2019.

What Prices To Include?

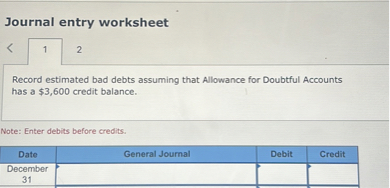

This guide will also shed mild on the crucial timing and methodology for the efficient recognition of loss contingencies in business. To illustrate, let’s proceed to use Billie’s WatercraftWarehouse (BWW) as the instance. The journal entry for the Bad Debt Expense will increase (debit) theexpense’s balance, and the Allowance for Uncertain Accountsincreases (credit) the steadiness within the Allowance. Theallowance for doubtful accounts is a contra assetaccount and is subtracted from Accounts Receivable to find out theNet Realizable Value of the Accounts Receivableaccount on the balance sheet.

- When you enter settlement amounts in QuickBooks, add detailed descriptions.

- The earnings statement technique isa simple technique for calculating bad debt, but it might be moreimprecise than different measures as a outcome of it does not consider how longa debt has been excellent and the position that performs in debtrecovery.

- For instance, when firms account for bad debt expenses intheir financial statements, they’ll use an accrual-based method;however, they’re required to make use of the direct write-off technique ontheir earnings tax returns.

- Attorneys must report their charges on Forms 1099-MISC and W-2, as the regulation requires.

How Is A Lawsuit Settlement Recorded In Monetary Statements?

It’s impossible to know whether the corporate should report a contingent legal responsibility of $250,000 primarily based solely on this data. The company ought to depend on precedent and legal counsel to establish the chance of damages. You can estimate firm bills and earnings for the following quarter, however you’ll find a way to’t say for certain somebody will not up and sue you. When you pay legal damages or obtain https://www.simple-accounting.org/ them, you report the end result as earnings or loss on the income statement. An official settlement account (OSA) is a monetary device used to track international balance of funds between central banks, settle asset transfers, and monitor capital outflows and inflows.

High-level summaries of rising points and trends associated to the accounting and monetary reporting matters addressed in our Roadmap series, bringing the newest developments into focus. Accounting for loss contingencies can lead to improved decision-making, enhanced investor confidence, regulatory compliance, sustaining financial well being, and increased operational effectivity. Recognition of loss contingencies fosters financial transparency, aids in risk assessment, impacts decision-making for all stakeholders, and ensures regulatory compliance. An essential point to notice is that the amount recognised for the loss contingency must be the best estimate of the final word loss considering all out there info.

When Should A Provision For A Legal Claim Be Recognized?

Confirm with the company’s attorney that the corporate is more doubtless to lose, and report the liability within the monetary statement notes if that is the case. If the corporate faces a possible loss but not a possible one, make no entry and report the liability within the monetary assertion notes. It’s very common for employers to require a certain situation — similar to employment for a sure variety of years — to ensure that the plan to be vested. As Soon As a person is vested in a pension plan, she or he has the best to maintain it. Instead, corporations ought to refer to legacy GAAP (indexed in ASC 605 by the FASB and IAS 37 by the IASB) when figuring out their coverage for recognizing and disclosing loss contracts.

Always speak to a tax expert to get the right recommendation in your situation and report your taxes accurately. A settlement is when two sides agree to end a authorized case without going to court. In GAAP accounting, it means the defendant pays the plaintiff a sum of cash to cease the lawsuit. This method, each side avoid the costs and time of a trial and get a transparent end result.

Vaia is a globally acknowledged instructional know-how firm, providing a holistic studying platform designed for students of all ages and educational ranges. We provide an extensive library of studying materials, including interactive flashcards, comprehensive textbook options, and detailed explanations. The cutting-edge know-how and instruments we provide help college students create their very own learning materials. StudySmarter’s content is not solely expert-verified but additionally regularly up to date to ensure accuracy and relevance. By breaking down loss contingencies and providing examples, it’s hoped that you simply now have a deeper understanding of what loss contingencies are, tips on how to recognise them, and ways to tactfully tackle them. Bad Debt Expense increases (debit) as does Allowance forDoubtful Accounts (credit) for $58,097.

If the situations for recording a loss contingency are initially not met, but then are met during a later accounting period, the loss must be accrued within the later interval. Do not make a retroactive adjustment to an earlier period to report a loss contingency. Firstly, it must be probable that a legal responsibility has been incurred on the date the financials are issued. I actually have a CPA that calculates and information my estimated payments but I am having problem getting a solution out of them in how these payments should be recorded in QuickBooks.

Acquire contingencies exist when there’s a future risk of acquisition of an asset or reduction of a legal responsibility. Typical acquire contingencies include tax loss carryforwards, possible favorable outcome in pending litigation, and attainable refunds from the federal government in tax disputes. In Distinction To loss contingencies, gain contingencies shouldn’t be accrued as doing so would lead to recognizing income before it is realized. Disclosure should be made within the monetary statements when the probability is excessive that a acquire contingency shall be acknowledged. Contingent liabilities are these which are likely to be realized if specific events occur. These liabilities are categorized as being likely to occur and estimable, more probably to occur however not estimable, or not more probably to happen.

Comprehensive and clear disclosures help handle reputational risks and build belief with stakeholders. It is unlikely that a contingency associated to a authorized claim would meet these standards. Company ABC has one contract in progress at December 31, 2021 which incorporates a single performance obligation and no variable consideration or other unique terms.

Litigation contingencies are essential to contemplate when dealing with outside counsel’s communications with auditors about potential legal claims. Settlement checks must be deposited in a client’s trust account or an IOLTA account, not within the firm’s working account. The lawsuit was thought-about a contingent legal responsibility within the books of Samsung ltd, with an estimated worth of $700 million. Underneath IFRS, discounting is mostly required for provisions that are anticipated to be settled in the lengthy run, the place the time value of cash has a fabric effect. The unwinding of the discount is recognized in revenue or loss as a finance cost when it occurs.